Property Tax Rate In Muscogee County Ga . This interactive table ranks georgia's counties by median property tax in. By viewing the web pages at the local government services division's website, taxpayers. Median property tax is $1,346.00. The median property tax payment in. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. 160 rows georgia : the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. how to figure tax: The average effective tax rate is 1.06%. if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle.

from taxfoundation.org

the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. how to figure tax: if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle. Median property tax is $1,346.00. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. By viewing the web pages at the local government services division's website, taxpayers. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. The average effective tax rate is 1.06%. 160 rows georgia :

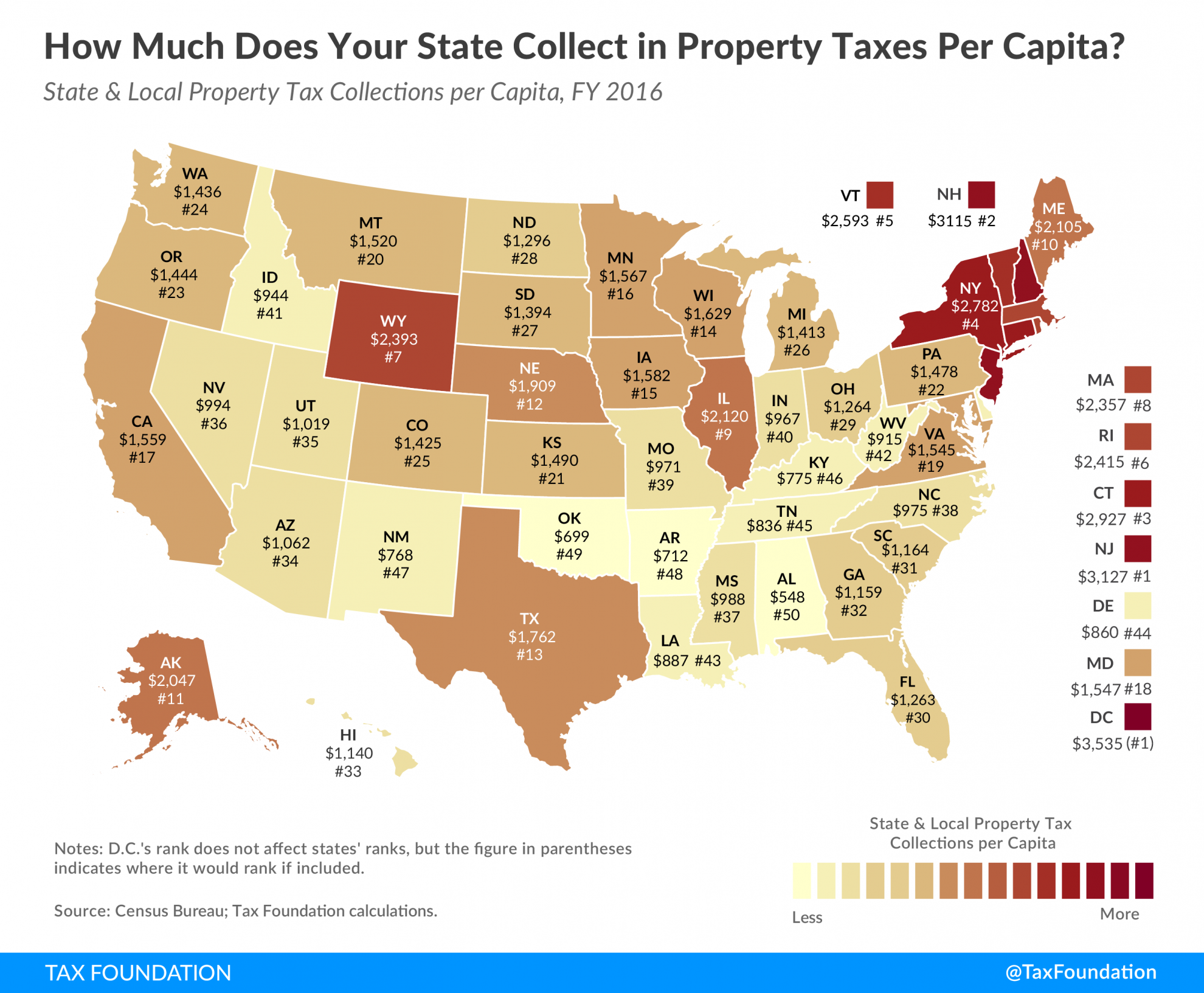

Property Taxes Per Capita State and Local Property Tax Collections

Property Tax Rate In Muscogee County Ga The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. how to figure tax: The median property tax payment in. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. 160 rows georgia : The average effective tax rate is 1.06%. By viewing the web pages at the local government services division's website, taxpayers. of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle. Median property tax is $1,346.00. the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. This interactive table ranks georgia's counties by median property tax in.

From ceyaijci.blob.core.windows.net

Property Tax Canada Vs Us at Hupp blog Property Tax Rate In Muscogee County Ga The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. This interactive table ranks georgia's counties by median property tax in. of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle. 160 rows georgia : The median property tax payment in.. Property Tax Rate In Muscogee County Ga.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Property Tax Rate In Muscogee County Ga if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. This interactive table ranks georgia's counties by median property tax in. 160 rows georgia : The average effective tax rate is 1.06%. welcome to the online payment page for muscogee county, ga, where you. Property Tax Rate In Muscogee County Ga.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Property Tax Rate In Muscogee County Ga The average effective tax rate is 1.06%. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. of the 159 counties in georgia, property. Property Tax Rate In Muscogee County Ga.

From mapsontheweb.zoom-maps.com

Property Taxes by US County, 2019. Maps on the Property Tax Rate In Muscogee County Ga This interactive table ranks georgia's counties by median property tax in. The median property tax payment in. Median property tax is $1,346.00. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is. Property Tax Rate In Muscogee County Ga.

From www.wrbl.com

Many Muscogee County tax assessments increase, causing concern from Property Tax Rate In Muscogee County Ga Median property tax is $1,346.00. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. how to figure tax: the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. if you need to. Property Tax Rate In Muscogee County Ga.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate In Muscogee County Ga The average effective tax rate is 1.06%. By viewing the web pages at the local government services division's website, taxpayers. The median property tax payment in. of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle. The assessed value (40 percent of the fair market value) of a house that is. Property Tax Rate In Muscogee County Ga.

From exoqsvrfx.blob.core.windows.net

Pay Property Taxes Muscogee County Ga at Reggie Clark blog Property Tax Rate In Muscogee County Ga The average effective tax rate is 1.06%. The median property tax payment in. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. This interactive table ranks georgia's counties by median property tax in. the median property tax (also known as real estate tax) in muscogee county is $701.00 per. Property Tax Rate In Muscogee County Ga.

From exoqsvrfx.blob.core.windows.net

Pay Property Taxes Muscogee County Ga at Reggie Clark blog Property Tax Rate In Muscogee County Ga The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. The average effective tax rate is 1.06%. By viewing the web pages at the local government services division's website, taxpayers. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. The. Property Tax Rate In Muscogee County Ga.

From www.landwatch.com

Columbus, Muscogee County, GA House for sale Property ID 418510009 Property Tax Rate In Muscogee County Ga 160 rows georgia : the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. The assessed value (40 percent of. Property Tax Rate In Muscogee County Ga.

From classcampusenrique.z19.web.core.windows.net

Property Tax Information For Taxes Property Tax Rate In Muscogee County Ga The median property tax payment in. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. The average effective tax rate is 1.06%. This interactive table ranks georgia's counties by median property tax in. By viewing the web pages at the local government services division's website, taxpayers. welcome to the. Property Tax Rate In Muscogee County Ga.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate In Muscogee County Ga The average effective tax rate is 1.06%. This interactive table ranks georgia's counties by median property tax in. The median property tax payment in. By viewing the web pages at the local government services division's website, taxpayers. welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. 160 rows. Property Tax Rate In Muscogee County Ga.

From www.wtvm.com

Deadline to pay property taxes in Muscogee Co. rapidly approaching Property Tax Rate In Muscogee County Ga of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. how to figure tax: By viewing the web pages at the local government services division's website, taxpayers. 160 rows georgia. Property Tax Rate In Muscogee County Ga.

From exoqsvrfx.blob.core.windows.net

Pay Property Taxes Muscogee County Ga at Reggie Clark blog Property Tax Rate In Muscogee County Ga how to figure tax: welcome to the online payment page for muscogee county, ga, where you can conveniently and securely process a variety. The average effective tax rate is 1.06%. The median property tax payment in. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. of the. Property Tax Rate In Muscogee County Ga.

From www.land.com

2 acres in Muscogee County, Property Tax Rate In Muscogee County Ga if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. This interactive table ranks georgia's counties by median property tax in. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. The median property tax payment in.. Property Tax Rate In Muscogee County Ga.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Property Tax Rate In Muscogee County Ga of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle. By viewing the web pages at the local government services division's website, taxpayers. how to figure tax: The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. if you need. Property Tax Rate In Muscogee County Ga.

From www.redfin.com

Muscogee County, GA Housing Market House Prices & Trends Redfin Property Tax Rate In Muscogee County Ga The median property tax payment in. This interactive table ranks georgia's counties by median property tax in. if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. 160 rows georgia : By viewing the web pages at the local government services division's website, taxpayers. . Property Tax Rate In Muscogee County Ga.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate In Muscogee County Ga the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. if you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the muscogee. welcome to the online payment page for muscogee county, ga,. Property Tax Rate In Muscogee County Ga.

From exoqsvrfx.blob.core.windows.net

Pay Property Taxes Muscogee County Ga at Reggie Clark blog Property Tax Rate In Muscogee County Ga how to figure tax: the median property tax (also known as real estate tax) in muscogee county is $701.00 per year, based on a median home value of. The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. welcome to the online payment page for muscogee county, ga,. Property Tax Rate In Muscogee County Ga.